Household incomes in Ireland are on course to overtake the UK

This week the Office for National Statistics released new data on regional gross disposable household incomes in the UK. Comparing this with data on disposable income per person in Ireland highlights the differences and similarities between the British and Irish economies.

Average disposable income1 per person across the UK in 2020 was £21,440. According to the provisional data for 2020, average disposable income per person in Ireland was €23,615, which was £20,999 as at exchange rates at the end of 2020 (£1 = €1.1246). At the time of writing (16 October 2022), £1 is worth €1.15.

Whilst average incomes in the UK were higher, in 2020 average incomes in Ireland grew by 7.2% compared with the previous year, whilst in the UK incomes fell by 0.2%.

Using exchange rates as at the end of 2020, average disposable incomes in Ireland were higher than all of the regions and countries in the UK outside the south of England. Northern Ireland fell below the North East of England, becoming the poorest area of the UK or Ireland by average income.

Since the year 2000, the Republic of Ireland has seen higher income growth than any area of the UK outside London, with Northern Ireland ranked third.

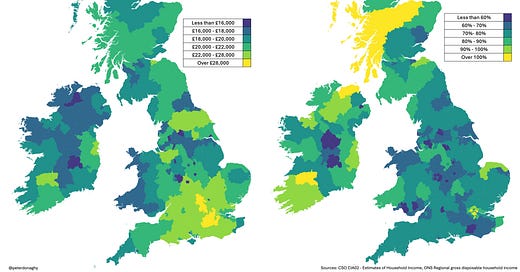

The map below shows average disposable income per person for 2020 for the regions of the UK and Ireland (in £), compared with growth in average disposable income since the year 2000 (in local currency).

This map demonstrates the differences between the British and Irish economic models. Outside London and the South East, in the UK poor and economically stagnant cities tend to be surrounded by more affluent hinterlands. By contrast, Irish cities such as Dublin, Limerick and Cork are thriving, and the poorer regions are found in remote rural areas.

London, which was already far wealthier than the rest of the UK, has accelerated even further away from the rest of the country since the turn of the millennium. The rich areas are getting richer still, a demonstration of how sucessive British governments are failing in their expressed desire to “level up” poorer areas of the country.

Alongside Bradford, Coventry, Nottingham and Leicester, Belfast is one of the cities in the “problem corner” of the British and Irish economies, with simultaneously low income and low income growth.

Income growth in the west of Northern Ireland (Derry City & Strabane and Fermanagh & Omagh) has been stronger, albeit from a very low base. Causeway Coast & Glens has seen some of the most rapid income growth in the UK and Ireland; only the Orkney Islands and parts of inner London have seen faster growth since 2020.

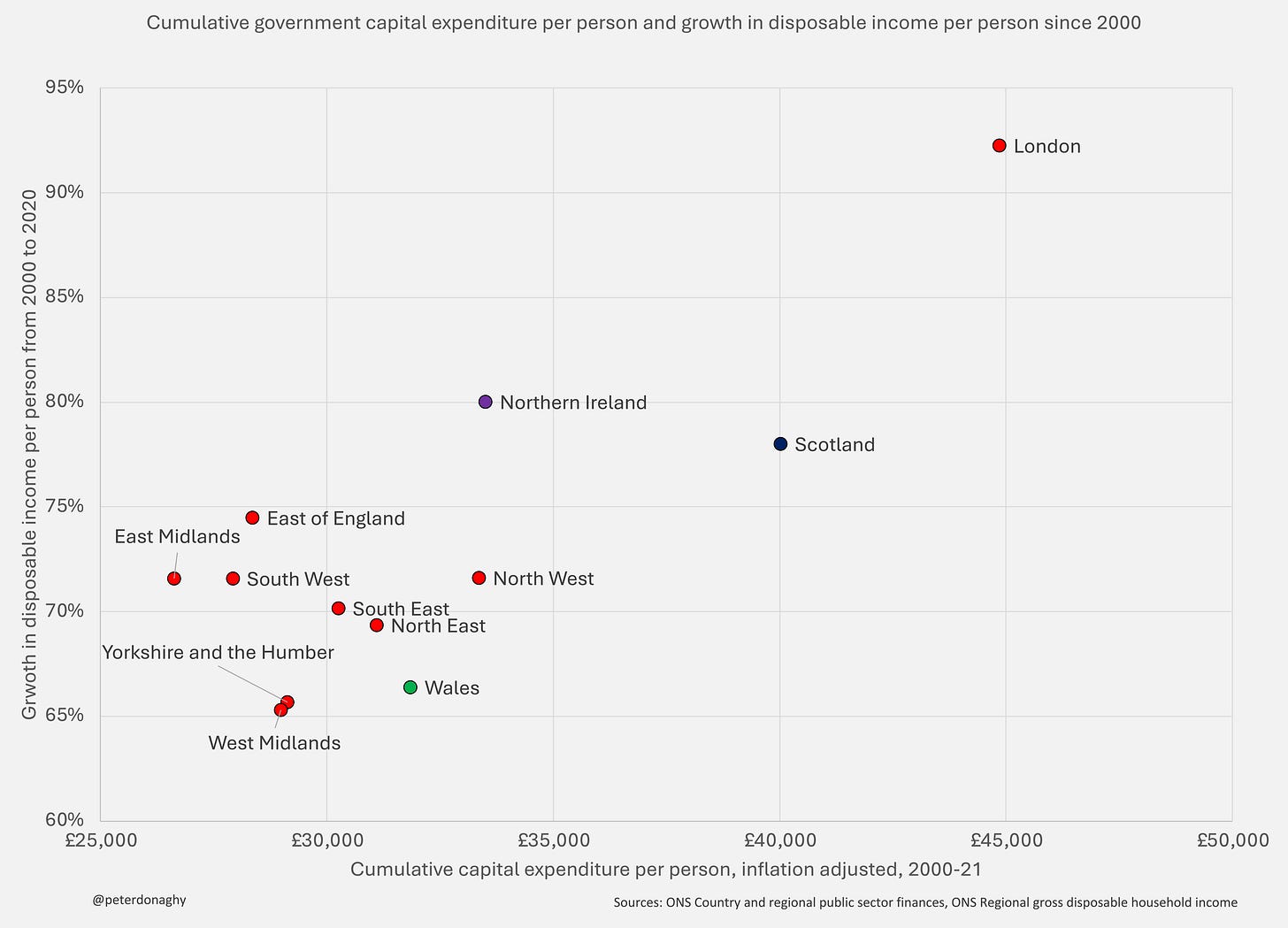

So, what is driving the vast disparity in income growth across the UK? Looking at cumulative capital expenditure per person (inflation adjusted) since 2000, there is a clear relationship between government investment and income growth. London has attracted the lion’s share of capital spending since the turn of the millennium, and accordingly has seen the highest growth in incomes.

Following the disastrous “mini-budget” of September 2022, the new Chancellor Jeremy Hunt may be weighing up cuts in capital spending to alleviate some of the fiscal pressure that the British government now find themselves under. However, such cuts could dampen future income growth, which in turn would drive a fall in revenues from taxation; a financial doom loop.

Even before any mooted cuts in capital spending, the Irish government intended to spend more per person in 2022 (€2,3702 / £2,062), with expected capital expenditure for 2022/23 per person in the UK expected to be £1,6543.

On their respective current trajectories, average incomes in Ireland will overtake those of the UK within the next couple of years. Irish government 30 year bond yields are currently 3.36%, with the equivalent for British gilts is 4.78%, meaning that the British government will need to pay to borrow than the Irish government.

The Irish government is expected to run a surplus of €1 billion in 2022 and €6.2 billion in 2023, whilst the British government is expected to run eye-watering deficits over the coming years. Given these constraints, it is going to be a challenge for the UK to improve its gloomy economic prognosis for quite a while.

“Disposable income” means income available to households such as salaries, self-employment, dividends, pensions and benefits, less any taxes, social insurance contributions and interest on financial liabilities.

€12bn in total, taken from https://www.oireachtas.ie/en/debates/question/2022-03-01/54/ (converted as €1 = £0.87)

£113.6bn in total, taken from https://obr.uk/forecasts-in-depth/brief-guides-and-explainers/public-finances/